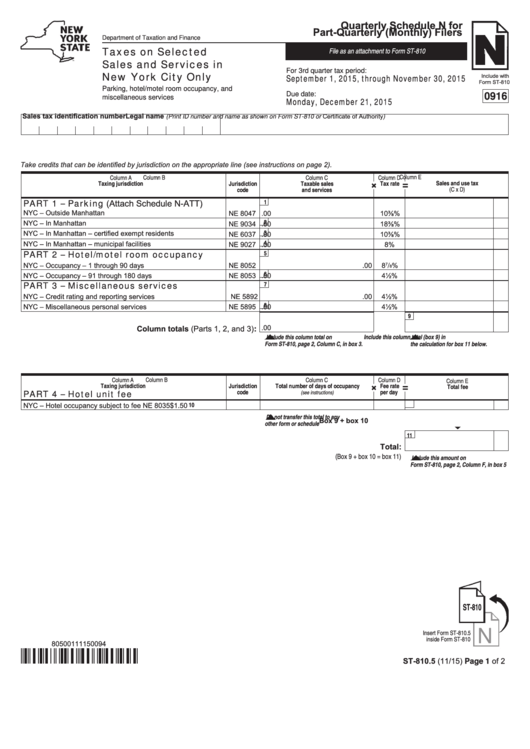

New York Sales Tax 2015. Select the new york city from the list of popular cities below to see its current sales tax rate. 10601, 10602, 10603, 10605 and 10606. All cities and counties in the state (except those counties wholly within new york Proof of sales tax payment or sales tax exemption, or purchase pricewhen you register a vehicle in new york (at a dmv office), you must eitherpay the sales taxprove that sales tax was paidprove your vehicle registration is exempt from sales taxyou probably also will need to pay county use tax when you register. The sales tax jurisdiction name is clarkstown, which may refer to a local government division. 0.5% lower than the maximum sales tax in ny. Priorities for reform — a fiscal policy institute report www.fiscalpolicy.org. Adjusted for correction adding $238 million to for nyc in calendar year 2015. You may need to report this information on your 2021 federal income tax return. There are a total of 988 local tax jurisdictions across the state, collecting an average local tax of 4.229%. Once fully phased in, the package will lower the corporate rate from 7.1 to 6.5 percent, eliminate the capital stock tax and corporate alternative minimum tax, extend net operating loss carrybacks. Sales tax applies to retail sales of certain tangible personal property and services. Remember that zip code boundaries don't always match up with political boundaries (like coxsackie or greene county ), so you. The city sales tax rate is 4.5% on the service, there is no new york state sales tax. 7 rows new york's state sales tax was 4 percent in 2015.

The city sales tax rate is 4.5% on the service, there is no new york state sales tax. Adjusted for correction adding $238 million to for nyc in calendar year 2015. How to register for a sales tax permit in new york state. The new york state sales tax rate is 4%, and the average ny sales tax after local surtaxes is 8.48%. The 8.375% sales tax rate in new city consists of 4% new york state sales tax, 4% rockland county sales tax and 0.375% special tax. Remember that zip code boundaries don't always match up with political boundaries (like coxsackie or greene county ), so you. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. There are approximately 2,955 people living in the coxsackie area. The higher rate will apply to all taxable sales, including deliveries, hotel occupancy, services, and use. The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in manhattan.

Malloy Said The First Reduction Would Come Around Nov.

Use tax applies if you buy tangible personal property and services outside the state and use it within new york state. Need an updated list of new york sales tax rates for your business? 0.5% lower than the maximum sales tax in ny. The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in manhattan. Counties and cities can charge an additional local sales tax of up to 4.875%, for a maximum possible combined sales tax of 8.875%. New york's corporate income tax ranking improved from 24th to 20th as a result of corporate tax reform passed this year that is starting to phase in. Remember that zip code boundaries don't always match up with political boundaries (like coxsackie or greene county ), so you. There is no applicable city tax. Once fully phased in, the package will lower the corporate rate from 7.1 to 6.5 percent, eliminate the capital stock tax and corporate alternative minimum tax, extend net operating loss carrybacks.

8.05 Cents Per Gallon Of Regular Gasoline, 8.00 Cents Per Gallon Of Diesel.

There are a total of 988 local tax jurisdictions across the state, collecting an average local tax of 4.229%. Select the new york city from the list of popular cities below to see its current sales tax rate. Includes new york city (nyc). The 8.375% sales tax rate in new city consists of 4% new york state sales tax, 4% rockland county sales tax and 0.375% special tax. New york (ny) sales tax rates by city new york (ny) sales tax rates by city the state sales tax rate in new york is 4.000%. An alternative sales tax rate of 8.375% applies in the tax region harrison, which appertains to zip code 10610. 2015 new york sales tax rates by zip code: For taxpayers in the state of new york, there’s new york city, and then there’s everywhere else. Sales tax applies to retail sales of certain tangible personal property and services.

The State Of New York Does Not Imply Approval Of The Listed Destinations, Warrant The Accuracy Of Any Information Set Out In Those Destinations, Or Endorse Any Opinions Expressed Therein.

The white plains, new york sales tax rate of 8.375% applies to the following five zip codes: All cities and counties in the state (except those counties wholly within new york Adjusted for correction adding $238 million to for nyc in calendar year 2015. 7 rows new york's state sales tax was 4 percent in 2015. There are approximately 2,955 people living in the coxsackie area. Priorities for reform — a fiscal policy institute report www.fiscalpolicy.org. Sales and use tax in the city of yonkers, new york, will increase from 8⅜% to 8⅞%, effective september 1, 2015. You may need to report this information on your 2021 federal income tax return. New york has recent rate changes (sun sep 01 2019).

The Sales Tax Jurisdiction Name Is Clarkstown, Which May Refer To A Local Government Division.

See estimate registration fees and taxes for information about Historically, new york’s tax structure has led many individuals and companies to purchase and house their aircraft in neighboring states, aopa officials noted. Taxes with a local option sales tax that is administered by the new york state department of taxation and finance.6 the statewide sales tax was initially 2 percent and has been as high as 4.25 percent; It is currently 4 percent. New york sales tax revenue grew 1.6 percent during the first. For information on the oneida nation settlement agreement, see oneida nation settlement agreement. 10601, 10602, 10603, 10605 and 10606. Download our new york sales tax database! If products are purchased, an 8.875% combined city and state tax will be charged.